StopTrail(Limit)

Release 1.9.35.116 adds the StopTrail and StopTrailLimit order

execution types to the backtesting arsenal.

Note

This is only implemented in backtesting and there isn’t yet an implementation for live brokers

Note

Updated with release 1.9.36.116. Interactive Brokers support for

StopTrail, StopTrailLimit and OCO.

-

OCOSpecify always the 1st order in a group as parameteroco -

StopTrailLimit: the broker simulation and theIBbroker have the asme behavior. Specify:priceas the initial stop trigger price (specify alsotrailamount) and thenplimias the initial limit price. The difference between the two will determine thelimitoffset(the distance at which the limit price remains from the stop trigger price)

The usage pattern is fully integrated into the standard buy, sell and

close market operation methods of the strategy instances. To notice:

-

Indicate which execution type is wished as in

exectype=bt.Order.StopTrail -

And whether the trailing price must be calculated with a fixed distance or with a percentage based distance

-

Fixed distance:

trailamount=10 -

Percentage based distance:

trailpercent=0.02(i.e.:2%)

-

If one has entered the market long by issuing a buy, this is what a

sell with StopTrail and trailamount does:

-

If no

priceis specified, the latestcloseprice is used -

trailamountis substracted from the price to find thestop(or trigger) price -

The next iteration of the broker checks if the trigger price has been reached

-

If Yes: the order is executed with a

Marketexecution type approach -

If No, the

stopprice is recalculated by using the latestcloseprice and substracting thetrailamountdistance -

If the new price goes up, it is updated

-

If the new price would go down (or not change at all), it is discarded

-

That is: the trailing stop price follows the price upwards, but remains fixed if the prices start falling, to potentially secure a profit.

If one had entered the market with a sell, then issuing a buy order

with StopTrail simply does the opposite, i.e.: prices are followed

downwards.

Some usage patterns

# For a StopTrail going downwards

# last price will be used as reference

self.buy(size=1, exectype=bt.Order.StopTrail, trailamount=0.25)

# or

self.buy(size=1, exectype=bt.Order.StopTrail, price=10.50, trailamount=0.25)

# For a StopTrail going upwards

# last price will be used as reference

self.sell(size=1, exectype=bt.Order.StopTrail, trailamount=0.25)

# or

self.sell(size=1, exectype=bt.Order.StopTrail, price=10.50, trailamount=0.25)

One can also specify trailpercent instead of trailamount and the

distance to the price will be calculated as a percentage of the price

# For a StopTrail going downwards with 2% distance

# last price will be used as reference

self.buy(size=1, exectype=bt.Order.StopTrail, trailpercent=0.02)

# or

self.buy(size=1, exectype=bt.Order.StopTrail, price=10.50, trailpercent=0.0.02)

# For a StopTrail going upwards with 2% difference

# last price will be used as reference

self.sell(size=1, exectype=bt.Order.StopTrail, trailpercent=0.02)

# or

self.sell(size=1, exectype=bt.Order.StopTrail, price=10.50, trailpercent=0.02)

For a StopTrailLimit

-

The only difference is what happens when the trailing stop price is triggered.

-

In this case the order is executed as a

Limitorder (the same behavior aStopLimitorder has, but in this case with a dynamic triggering price)Note

one has to specify

plimit=x.xtobuyorsell, which will be the limit priceNote

the limit price is not changed dynamically like the stop/trigger price

An example is always worth a thousand words and hence the usual backtrader sample, which

-

Uses a moving average crossing up to enter the market long

-

Uses a trailing stop to exit the market

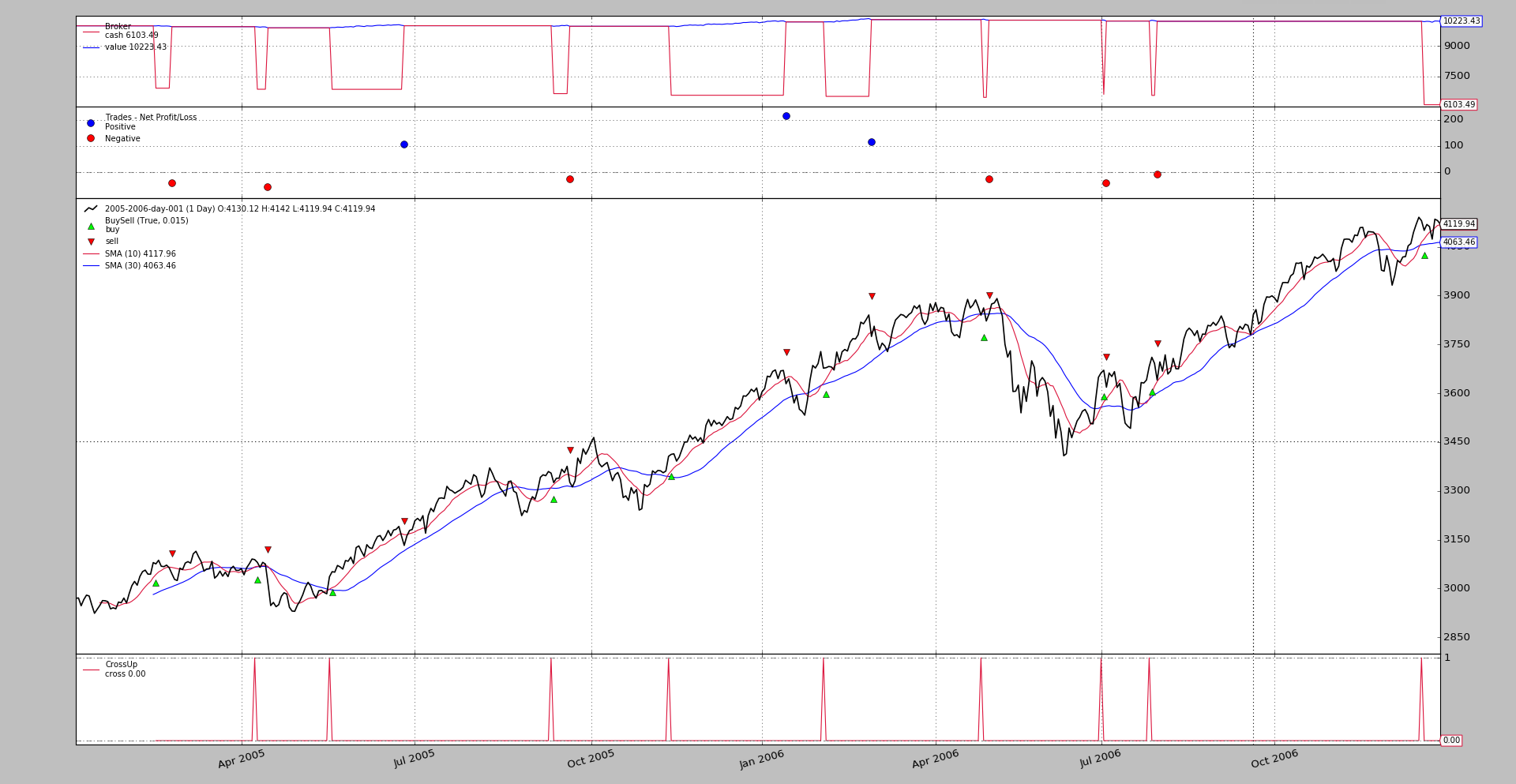

The execution with 50 points of fixed price distance

$ ./trail.py --plot --strat trailamount=50.0

Which produces the following chart

And the following output:

**************************************************

2005-02-14,3075.76,3025.76,3025.76

----------

2005-02-15,3086.95,3036.95,3036.95

2005-02-16,3068.55,3036.95,3018.55

2005-02-17,3067.34,3036.95,3017.34

2005-02-18,3072.04,3036.95,3022.04

2005-02-21,3063.64,3036.95,3013.64

...

...

**************************************************

2005-05-19,3051.79,3001.79,3001.79

----------

2005-05-20,3050.45,3001.79,3000.45

2005-05-23,3070.98,3020.98,3020.98

2005-05-24,3066.55,3020.98,3016.55

2005-05-25,3059.84,3020.98,3009.84

2005-05-26,3086.08,3036.08,3036.08

2005-05-27,3084.0,3036.08,3034.0

2005-05-30,3096.54,3046.54,3046.54

2005-05-31,3076.75,3046.54,3026.75

2005-06-01,3125.88,3075.88,3075.88

2005-06-02,3131.03,3081.03,3081.03

2005-06-03,3114.27,3081.03,3064.27

2005-06-06,3099.2,3081.03,3049.2

2005-06-07,3134.82,3084.82,3084.82

2005-06-08,3125.59,3084.82,3075.59

2005-06-09,3122.93,3084.82,3072.93

2005-06-10,3143.85,3093.85,3093.85

2005-06-13,3159.83,3109.83,3109.83

2005-06-14,3162.86,3112.86,3112.86

2005-06-15,3147.55,3112.86,3097.55

2005-06-16,3160.09,3112.86,3110.09

2005-06-17,3178.48,3128.48,3128.48

2005-06-20,3162.14,3128.48,3112.14

2005-06-21,3179.62,3129.62,3129.62

2005-06-22,3182.08,3132.08,3132.08

2005-06-23,3190.8,3140.8,3140.8

2005-06-24,3161.0,3140.8,3111.0

...

...

...

**************************************************

2006-12-19,4100.48,4050.48,4050.48

----------

2006-12-20,4118.54,4068.54,4068.54

2006-12-21,4112.1,4068.54,4062.1

2006-12-22,4073.5,4068.54,4023.5

2006-12-27,4134.86,4084.86,4084.86

2006-12-28,4130.66,4084.86,4080.66

2006-12-29,4119.94,4084.86,4069.94

Rather than waiting for the usual cross down pattern the system uses the trailing stop to exit the market. Let’s see the 1st operation for example

-

Closing price when entering long:

3075.76 -

System calculated trail stop price:

3025.76(which is50units away) -

Sample calculated trail stop price:

3025.76(last price shown in each line)

After this first calculation:

-

The closing price goes up to

3086.95and the stop price is adjusted to3036.95 -

The following closing prices don’t exceed

3086.95and the trigger price doesn’t change

The same pattern can be seen in the other 2 operations.

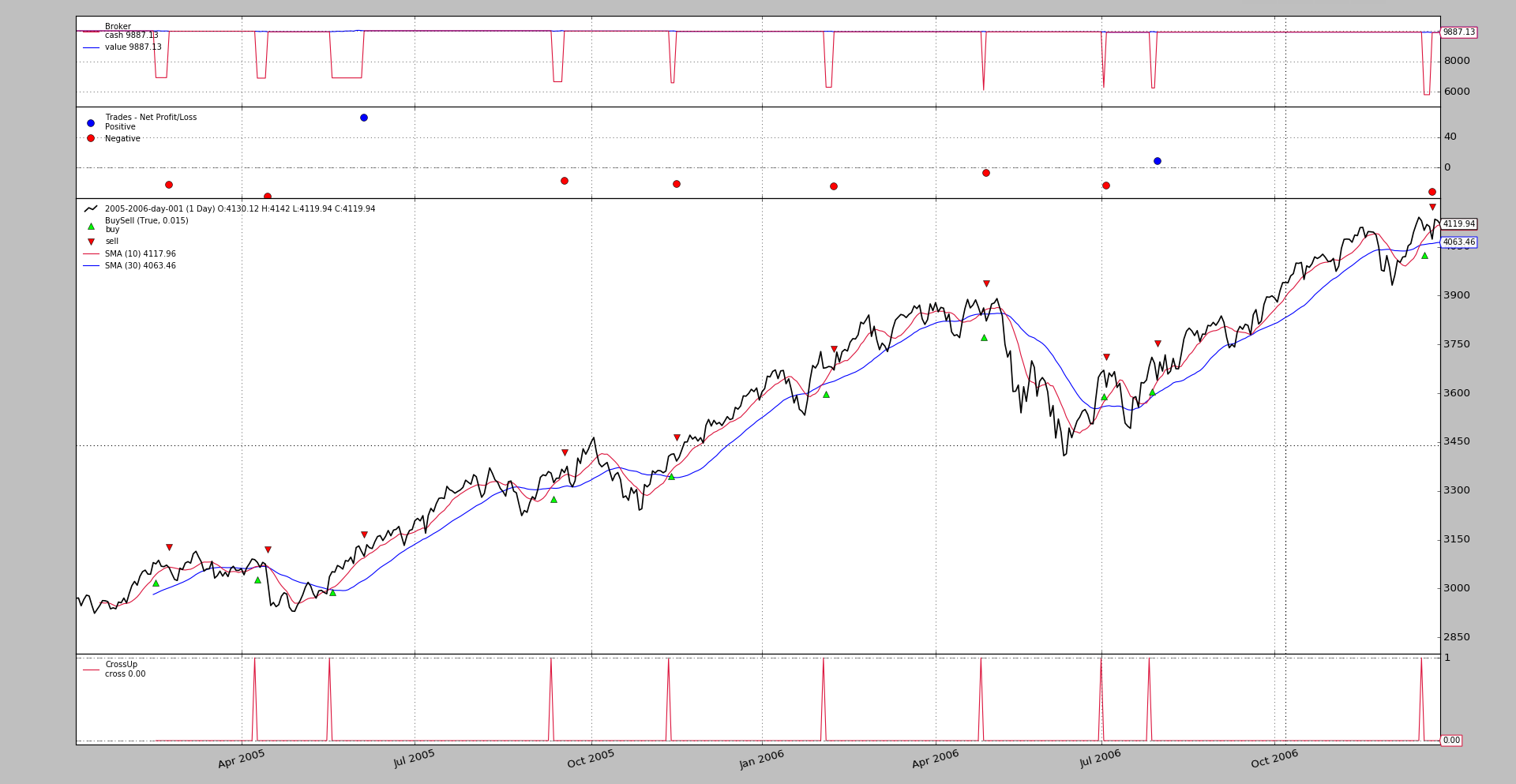

For the sake of comparison, an execution with just 30 points of fixed

distance (just the chart)

$ ./trail.py --plot --strat trailamount=30.0

And the chart

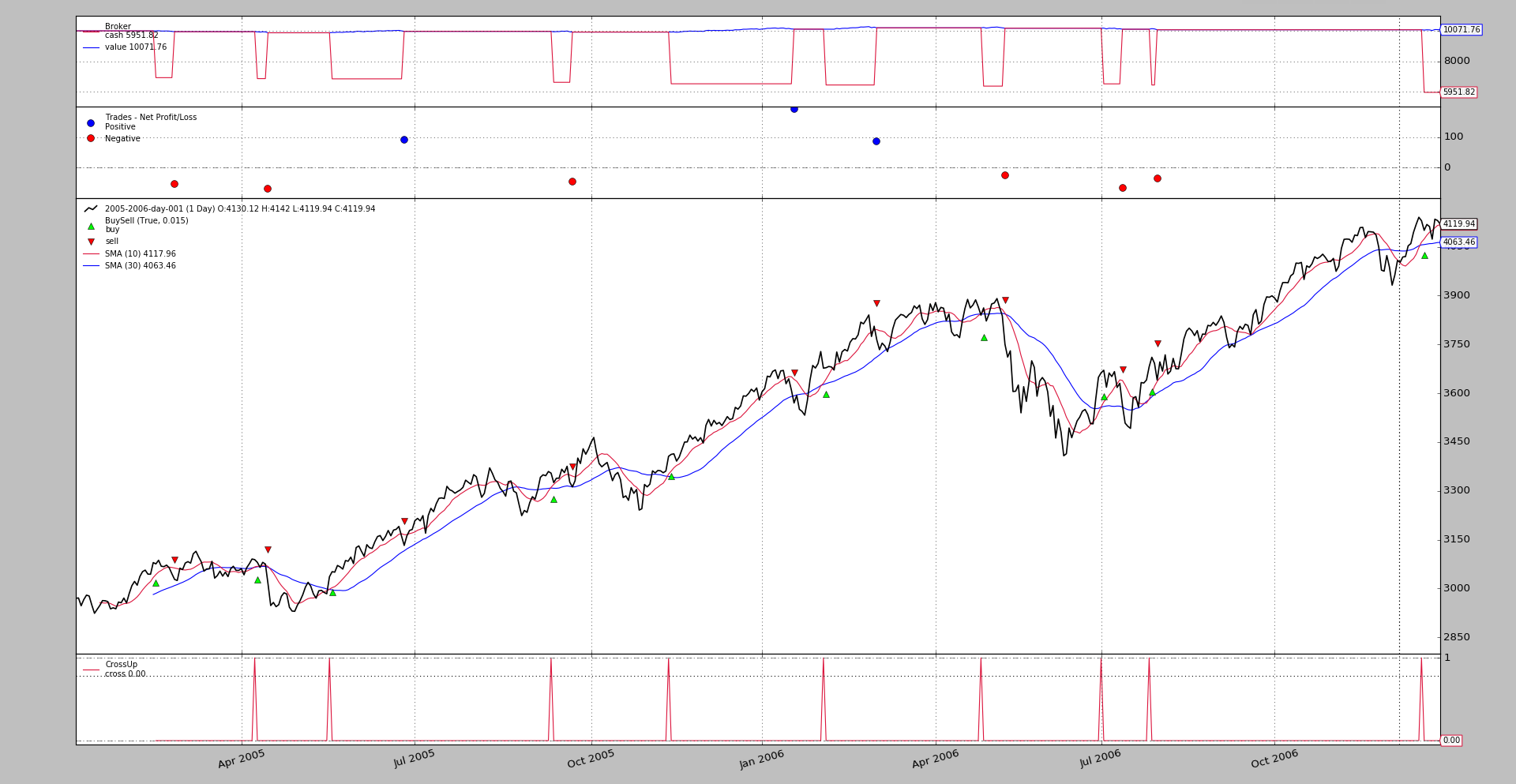

Followed by one last execution with trailpercent=0.02

$ ./trail.py --plot --strat trailpercent=0.02

The corresponding chart.

The sample usage

$ ./trail.py --help

usage: trail.py [-h] [--data0 DATA0] [--fromdate FROMDATE] [--todate TODATE]

[--cerebro kwargs] [--broker kwargs] [--sizer kwargs]

[--strat kwargs] [--plot [kwargs]]

StopTrail Sample

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data to read in (default:

../../datas/2005-2006-day-001.txt)

--fromdate FROMDATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--todate TODATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--cerebro kwargs kwargs in key=value format (default: )

--broker kwargs kwargs in key=value format (default: )

--sizer kwargs kwargs in key=value format (default: )

--strat kwargs kwargs in key=value format (default: )

--plot [kwargs] kwargs in key=value format (default: )

The sample code

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import backtrader as bt

class St(bt.Strategy):

params = dict(

ma=bt.ind.SMA,

p1=10,

p2=30,

stoptype=bt.Order.StopTrail,

trailamount=0.0,

trailpercent=0.0,

)

def __init__(self):

ma1, ma2 = self.p.ma(period=self.p.p1), self.p.ma(period=self.p.p2)

self.crup = bt.ind.CrossUp(ma1, ma2)

self.order = None

def next(self):

if not self.position:

if self.crup:

o = self.buy()

self.order = None

print('*' * 50)

elif self.order is None:

self.order = self.sell(exectype=self.p.stoptype,

trailamount=self.p.trailamount,

trailpercent=self.p.trailpercent)

if self.p.trailamount:

tcheck = self.data.close - self.p.trailamount

else:

tcheck = self.data.close * (1.0 - self.p.trailpercent)

print(','.join(

map(str, [self.datetime.date(), self.data.close[0],

self.order.created.price, tcheck])

)

)

print('-' * 10)

else:

if self.p.trailamount:

tcheck = self.data.close - self.p.trailamount

else:

tcheck = self.data.close * (1.0 - self.p.trailpercent)

print(','.join(

map(str, [self.datetime.date(), self.data.close[0],

self.order.created.price, tcheck])

)

)

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

# Data feed kwargs

kwargs = dict()

# Parse from/to-date

dtfmt, tmfmt = '%Y-%m-%d', 'T%H:%M:%S'

for a, d in ((getattr(args, x), x) for x in ['fromdate', 'todate']):

if a:

strpfmt = dtfmt + tmfmt * ('T' in a)

kwargs[d] = datetime.datetime.strptime(a, strpfmt)

# Data feed

data0 = bt.feeds.BacktraderCSVData(dataname=args.data0, **kwargs)

cerebro.adddata(data0)

# Broker

cerebro.broker = bt.brokers.BackBroker(**eval('dict(' + args.broker + ')'))

# Sizer

cerebro.addsizer(bt.sizers.FixedSize, **eval('dict(' + args.sizer + ')'))

# Strategy

cerebro.addstrategy(St, **eval('dict(' + args.strat + ')'))

# Execute

cerebro.run(**eval('dict(' + args.cerebro + ')'))

if args.plot: # Plot if requested to

cerebro.plot(**eval('dict(' + args.plot + ')'))

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description=(

'StopTrail Sample'

)

)

parser.add_argument('--data0', default='../../datas/2005-2006-day-001.txt',

required=False, help='Data to read in')

# Defaults for dates

parser.add_argument('--fromdate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--todate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--cerebro', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--broker', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--sizer', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--strat', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--plot', required=False, default='',

nargs='?', const='{}',

metavar='kwargs', help='kwargs in key=value format')

return parser.parse_args(pargs)

if __name__ == '__main__':

runstrat()