Data Synchronization Rework

In the latest release the minor number has been moved from 8 to 9 to indicate a change which may have some behavioral impact, regardless, even if compatibility has been taken into account.

With release 1.9.0.99 the entire mechanism to synchronize multiple datas using datetime has been reworked (for both next and once modes).

Note

All standard test cases get a nice OK from nosetests, but complex

uses cases might uncover corner cases not covered.

The previous behavior was discussed in tickets #39, #76, #115 and #129 and this has been the basis to deprecate the old behavior.

Now, the datetime timestamp of the incoming prices is checked to align datas and deliver what’s new (older bars first). Benefits:

-

Non time aligned data can now be used.

-

In live feeds the behavior improves because the re-synchronizes automatically

Let’s recall that the old behavior used the 1st data introduced in the system as a master for time synchronization and no other data could be faster. The order of introduction of datas in the system plays no role now.

Part of the rework has addressed plotting which naively assumed all datas ended up having the same length, being this a consequence of having a time master. The new plotting code allows datas of different length.

Note

The old behavior is still available by using:

cerebro = bt.Cerebro(oldsync=True)

or:

cerebro.run(oldsync=True)

Seeing it with a sample

The multidata-strategy sample has been used as the basis for the

multidata-strategy-unaligned sample (in the same folder). Two data samples

have been manually altered to remove some bars. Both had 756 bars and have

been capped down to 753 at two different points in time

-

End of 2004, beginning of 2005 for

YHOO -

End of 2005 for

ORCL

As always, a execution is worth a thousand words.

First the old behavior

The execution:

$ ./multidata-strategy-unaligned.py --oldsync --plot

From the output, the important part is right at the end:

...

Self len: 753

Data0 len: 753

Data1 len: 750

Data0 len == Data1 len: False

Data0 dt: 2005-12-27 23:59:59

Data1 dt: 2005-12-27 23:59:59

...

To notice:

-

The strategy has a length of

753 -

The 1st data (time master) also has

753 -

The 2nd data (time slave) has

750

It’s not obvious from the output but the YHOO file contains data up to

2005-12-30, which is not being processed by the system.

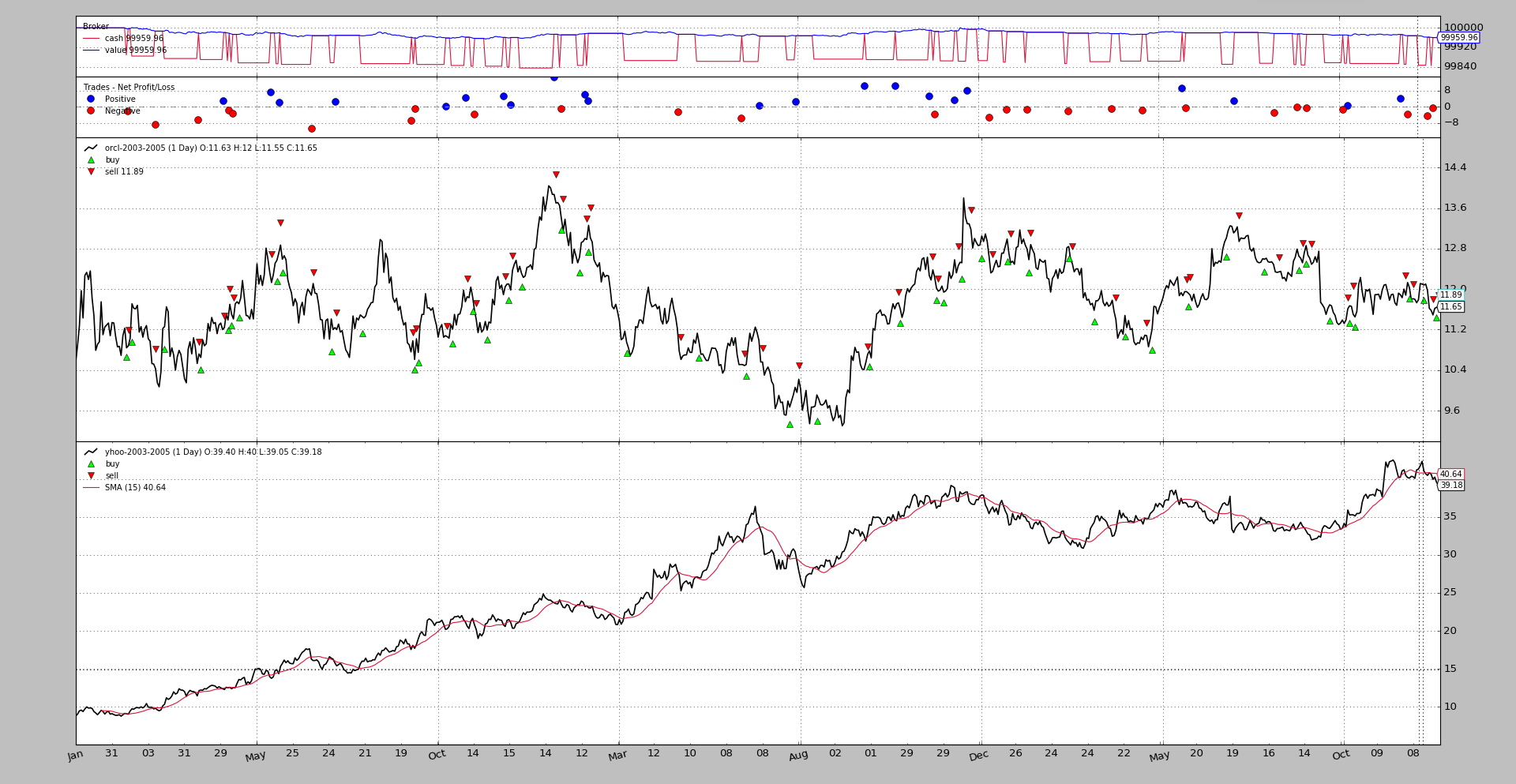

The visual chart

The new behavior

The execution:

$ ./multidata-strategy-unaligned.py --plot

From the output, the important part is right at the end:

...

Self len: 756

Data0 len: 753

Data1 len: 753

Data0 len == Data1 len: True

Data0 dt: 2005-12-27 23:59:59

Data1 dt: 2005-12-30 23:59:59

...

The behavior has obvioulsy improved:

-

The strategy goes to a length of

756and each of the datas to the full753data points. -

Because the removed data points don’t overlap the strategy ends up being

3units longer than the datas. -

2005-12-30has been reached withdata1(it’s one of the data points removed fordata0), so all datas have been processed to the very end

The visual chart

Although the charts do not exhibit major differences, they are actually different behind the scenes.

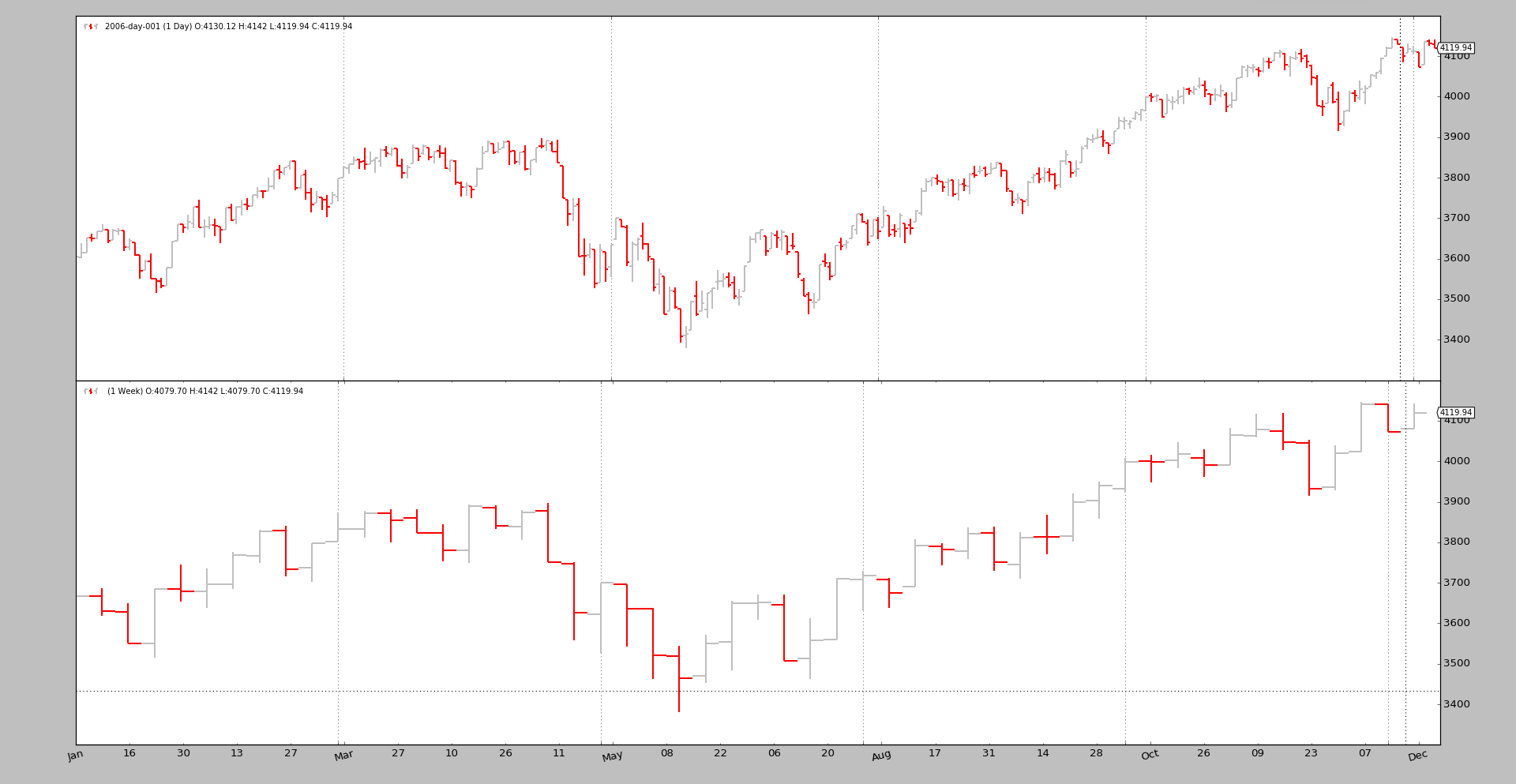

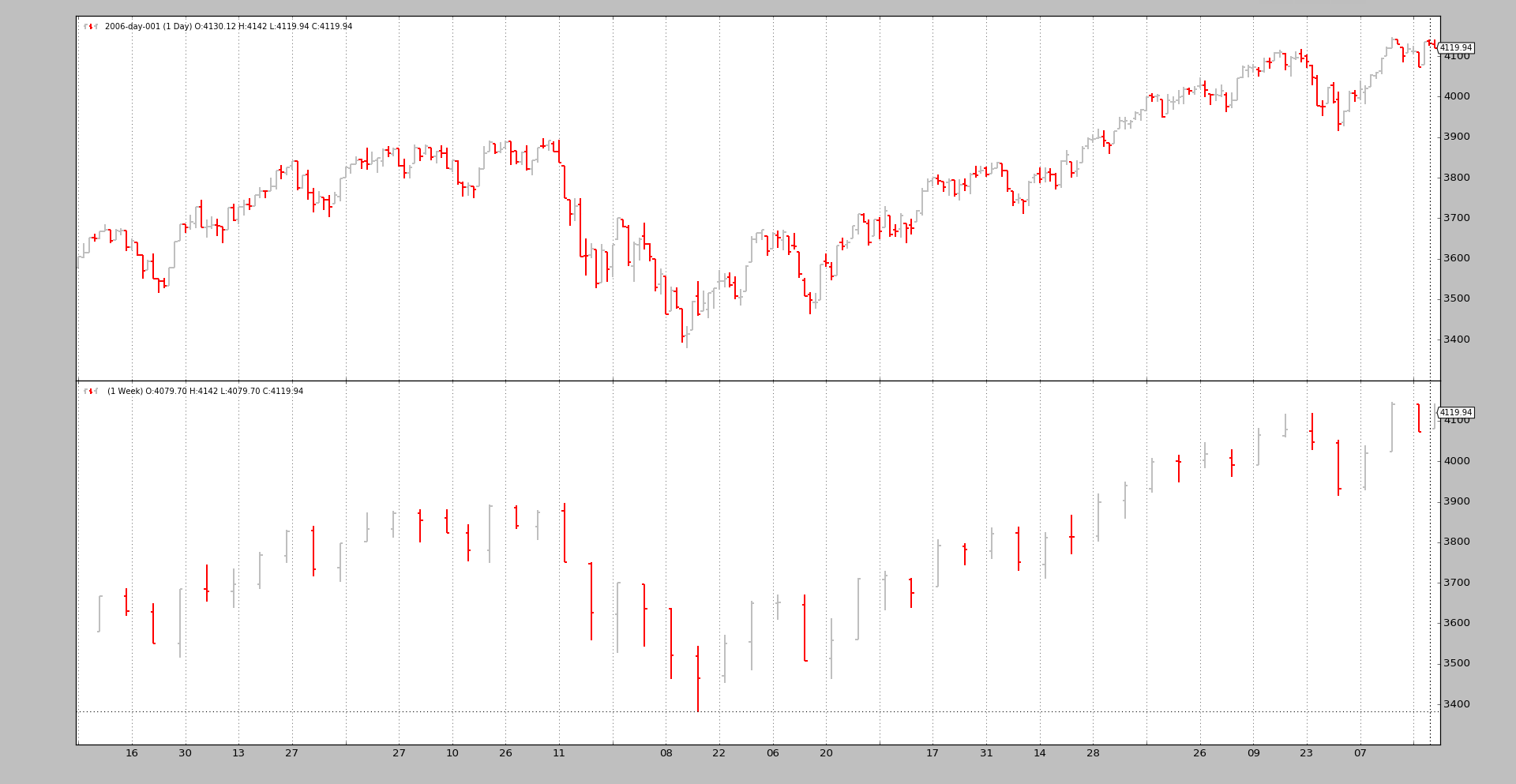

Another check

For the interested user, the data-multitimeframe sample has been updated to

also support a --oldsync parameter. Because now different length datas are

being plotted, the visual aspect of the larger time frame is better.

Execution with new synchronization model

Execution with old synchronization model

Sample Usage

$ ./multidata-strategy-unaligned.py --help

usage: multidata-strategy-unaligned.py [-h] [--data0 DATA0] [--data1 DATA1]

[--fromdate FROMDATE] [--todate TODATE]

[--period PERIOD] [--cash CASH]

[--runnext] [--nopreload] [--oldsync]

[--commperc COMMPERC] [--stake STAKE]

[--plot] [--numfigs NUMFIGS]

MultiData Strategy

optional arguments:

-h, --help show this help message and exit

--data0 DATA0, -d0 DATA0

1st data into the system

--data1 DATA1, -d1 DATA1

2nd data into the system

--fromdate FROMDATE, -f FROMDATE

Starting date in YYYY-MM-DD format

--todate TODATE, -t TODATE

Starting date in YYYY-MM-DD format

--period PERIOD Period to apply to the Simple Moving Average

--cash CASH Starting Cash

--runnext Use next by next instead of runonce

--nopreload Do not preload the data

--oldsync Use old data synchronization method

--commperc COMMPERC Percentage commission (0.005 is 0.5%

--stake STAKE Stake to apply in each operation

--plot, -p Plot the read data

--numfigs NUMFIGS, -n NUMFIGS

Plot using numfigs figures

Sample Code

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

# The above could be sent to an independent module

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class MultiDataStrategy(bt.Strategy):

'''

This strategy operates on 2 datas. The expectation is that the 2 datas are

correlated and the 2nd data is used to generate signals on the 1st

- Buy/Sell Operationss will be executed on the 1st data

- The signals are generated using a Simple Moving Average on the 2nd data

when the close price crosses upwwards/downwards

The strategy is a long-only strategy

'''

params = dict(

period=15,

stake=10,

printout=True,

)

def log(self, txt, dt=None):

if self.p.printout:

dt = dt or self.data.datetime[0]

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [bt.Order.Submitted, bt.Order.Accepted]:

return # Await further notifications

if order.status == order.Completed:

if order.isbuy():

buytxt = 'BUY COMPLETE, %.2f' % order.executed.price

self.log(buytxt, order.executed.dt)

else:

selltxt = 'SELL COMPLETE, %.2f' % order.executed.price

self.log(selltxt, order.executed.dt)

elif order.status in [order.Expired, order.Canceled, order.Margin]:

self.log('%s ,' % order.Status[order.status])

pass # Simply log

# Allow new orders

self.orderid = None

def __init__(self):

# To control operation entries

self.orderid = None

# Create SMA on 2nd data

sma = btind.MovAv.SMA(self.data1, period=self.p.period)

# Create a CrossOver Signal from close an moving average

self.signal = btind.CrossOver(self.data1.close, sma)

def next(self):

if self.orderid:

return # if an order is active, no new orders are allowed

if self.p.printout:

print('Self len:', len(self))

print('Data0 len:', len(self.data0))

print('Data1 len:', len(self.data1))

print('Data0 len == Data1 len:',

len(self.data0) == len(self.data1))

print('Data0 dt:', self.data0.datetime.datetime())

print('Data1 dt:', self.data1.datetime.datetime())

if not self.position: # not yet in market

if self.signal > 0.0: # cross upwards

self.log('BUY CREATE , %.2f' % self.data1.close[0])

self.buy(size=self.p.stake)

else: # in the market

if self.signal < 0.0: # crosss downwards

self.log('SELL CREATE , %.2f' % self.data1.close[0])

self.sell(size=self.p.stake)

def stop(self):

print('==================================================')

print('Starting Value - %.2f' % self.broker.startingcash)

print('Ending Value - %.2f' % self.broker.getvalue())

print('==================================================')

def runstrategy():

args = parse_args()

# Create a cerebro

cerebro = bt.Cerebro()

# Get the dates from the args

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

# Create the 1st data

data0 = btfeeds.YahooFinanceCSVData(

dataname=args.data0,

fromdate=fromdate,

todate=todate)

# Add the 1st data to cerebro

cerebro.adddata(data0)

# Create the 2nd data

data1 = btfeeds.YahooFinanceCSVData(

dataname=args.data1,

fromdate=fromdate,

todate=todate)

# Add the 2nd data to cerebro

cerebro.adddata(data1)

# Add the strategy

cerebro.addstrategy(MultiDataStrategy,

period=args.period,

stake=args.stake)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcash(args.cash)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcommission(commission=args.commperc)

# And run it

cerebro.run(runonce=not args.runnext,

preload=not args.nopreload,

oldsync=args.oldsync)

# Plot if requested

if args.plot:

cerebro.plot(numfigs=args.numfigs, volume=False, zdown=False)

def parse_args():

parser = argparse.ArgumentParser(description='MultiData Strategy')

parser.add_argument('--data0', '-d0',

default='../../datas/orcl-2003-2005.txt',

help='1st data into the system')

parser.add_argument('--data1', '-d1',

default='../../datas/yhoo-2003-2005.txt',

help='2nd data into the system')

parser.add_argument('--fromdate', '-f',

default='2003-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t',

default='2005-12-31',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--period', default=15, type=int,

help='Period to apply to the Simple Moving Average')

parser.add_argument('--cash', default=100000, type=int,

help='Starting Cash')

parser.add_argument('--runnext', action='store_true',

help='Use next by next instead of runonce')

parser.add_argument('--nopreload', action='store_true',

help='Do not preload the data')

parser.add_argument('--oldsync', action='store_true',

help='Use old data synchronization method')

parser.add_argument('--commperc', default=0.005, type=float,

help='Percentage commission (0.005 is 0.5%%')

parser.add_argument('--stake', default=10, type=int,

help='Stake to apply in each operation')

parser.add_argument('--plot', '-p', action='store_true',

help='Plot the read data')

parser.add_argument('--numfigs', '-n', default=1,

help='Plot using numfigs figures')

return parser.parse_args()

if __name__ == '__main__':

runstrategy()